What is ID Network?

ID Network (IDN) builds out a network graph based on large amounts of historical data (i.e. face data, device information, user identity information, etc) and uses computer vision algorithms, text algorithms, graph mining algorithms as well as retrieval techniques to identify large-scale batch fraud risks.

Risk introduction

ID Network effectively identifies the following three types of risks:

- Identity fraud risk

The information submitted by the user is not their real information e.g. they might have tampered with the portrait photo, ID card number, name, etc; on the document. - Duplicate authentication risk

The same user authenticates multiple accounts - Batch registration risk

Many people conduct identity verification in the same environment, such as using AI face-swap tool to impersonate others for loan application

Common examples of typical identity fraud risks:

- The same face appears on different IDs, with the same ID type but with different ID numbers or identity information.

- The same ID type and ID number corresponds to different faces.

- The same ID type and ID number corresponds to different identity information (i.e. name and date of birth).

- The same identity information i.e. same name and date of birth, corresponds to different faces or IDs.

Common examples of duplicate authentication risks:

- A certain business supports the use of ID cards or passports for identity authentication, which means that the same user can authenticate two real name accounts using two different documents. This poses a duplicate authentication risk. ID Network can identity whether the same face is on different documents to avoid duplicate authentication.

Common examples of batch registration risk:

- In bank loan scenario, frauders from black and gray industries use AI face-swap tool to impersonate others and make loans. ID Network can identify faces with similiar backgrounds to defend the AI-generated deepfake attacks.

Features

ID Network provides two main functions – database management and risk query.

- Database Management: Includes data entry and deletion, as well as record search.

- Risk Query: Specifies the user information and checks the risk associated with the user; usually used for in real-time query of fraud risk during business processes.

Database management

The database management includes three API interfaces, inbound, outbound and record query.

API | Description | Link |

add | Used to add a new record for storing. During this process, a risk query can also be performed. | |

remove | Used to delete a record. | |

get | Used to query the details of a record, including the portrait photo, identity information and the ID passed in during entry | |

risk query | Used to query the risks associated with a record. |

Risk query

The Risk Query API is used to query the risk associated with a specified record. It supports two risk query methods:

- Querying the risk associated with a record in the databaseWhen calling the risk query API, pass in the itemId parameter returned from the entry data, and specify the risk type and time window. The entry data can be queried corresponding to the specified itemId. If the risk type and time window are not specified, it will default to corresponding the record against the entire database and query through all possible risks.

- Query the risk of data that has not been entered into the database.

When calling the risk query API, pass in the imageInfo and basicInfo parameters to return the corresponding risk associated with that data. The API will compare it with all the data that has been entered into the database before.

Note: The itemId field has higher priority than imageInfo and basicInfo fields. As a result, if itemId, imageId and basicInfo fields are all passed in at the same time, only the itemId field will take priority and be used to query database risks.

You can specify the following data when making a risk inquiry:

- Specify the risk typeSpecifies the type of risk for the query. The risk types include two categories – identity fraud and duplicate authentication. One or more types of risks can be specified for querying. When more risks are being queried, the longer the process will take.

- Specify the time windowSpecifies a comparison with the database for a specific time window e.g. querying for data risks stored in the past 6 months. Limiting the time window can shorten the time spent on the interface. If the time window is not specified, the default is to query the risks within the entire database.

Integration modes

ID Network provides an API access mode for you to access the ZOLOZ service. For more information, see API integration for ID Network.

Use flow

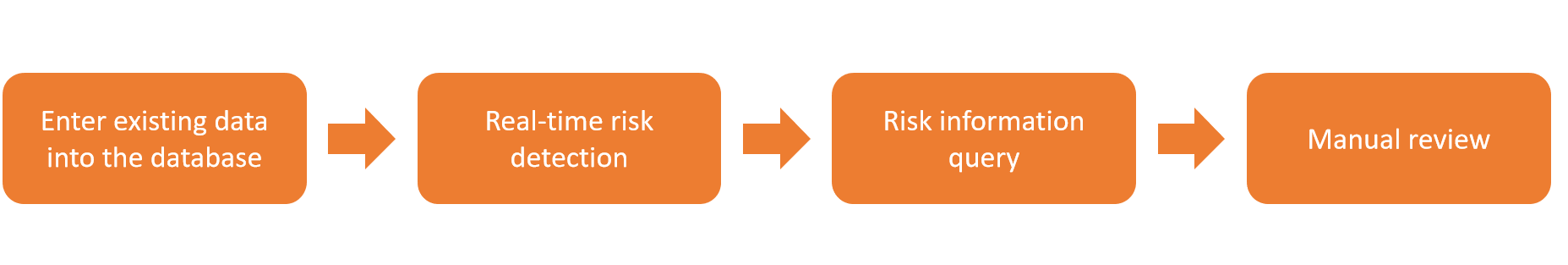

The use flow of ID Network is shown below:

Figure 1: ID Network use flow illustration

- Enter existing data into the database.

Call the add API to store images and identity information of existing users into the database. In order to improve response speed, it is recommended to turn off the risk query function when inputting into the database. - Real-time risk detection.

During the eKYC process, the add API is called to store the collected user information into the database, and at the same time, risk query is performed to determine whether there is any risk of identity fraud and batch registration. In order to improve response speed, a time window for querying risks can be set. The smaller the time window, the quicker the query speed. - Risk information query.

When the risk query identifies a risk, the riskData can be obtained in its risk details and the get API can be called to query detailed images and information associated with the riskData. - Manual review.

It is recommended to manually review multiple records with risks again before making the final decision.

To know more about ZOLOZ, contact us: https://www.zoloz.com/zoloz/getInTouch